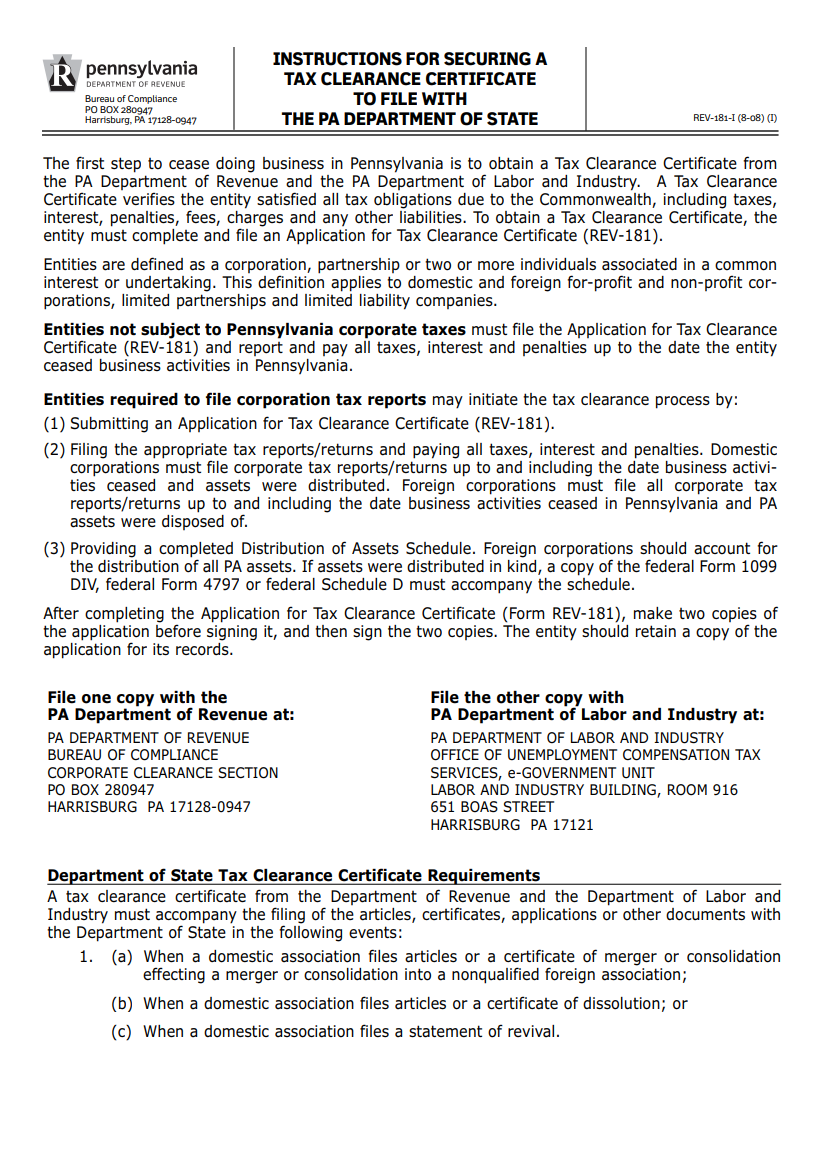

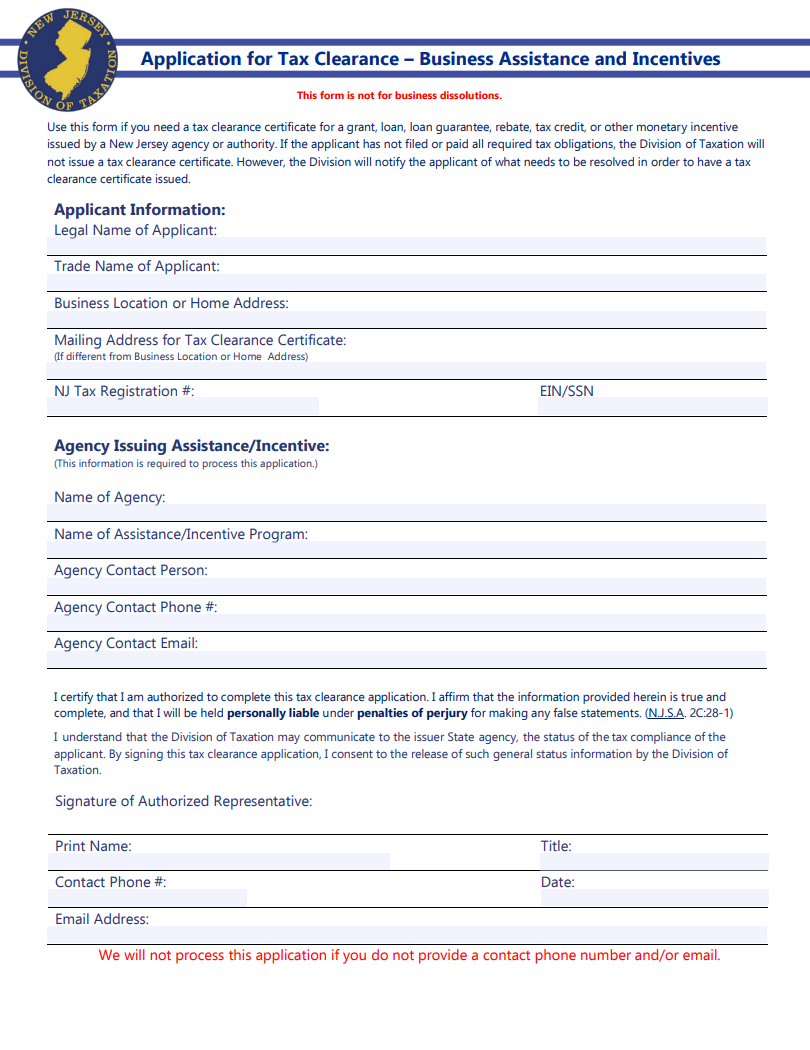

The tax clearance certificate template is a legal document that is issued by the government department or tax authority to an individual or organization confirming an individual or business has cleared all their taxes or tax dues. This certificate is an important document which will be required any time, especially for organizations. Moreover, it can be useful in different situations, like when a business wants to discontinue its services or production, transferring ownership to another person, partnership with other businesses or when the business owner expires and his or her assets are transferred to his or her heirs. Furthermore, the tax clearance certificate ensures the purchasing party that the existing business has no unpaid taxes or cleared all their tax dues so that the new business owner is not responsible for unpaid taxes.

Content of Tax Clearance Certificate:

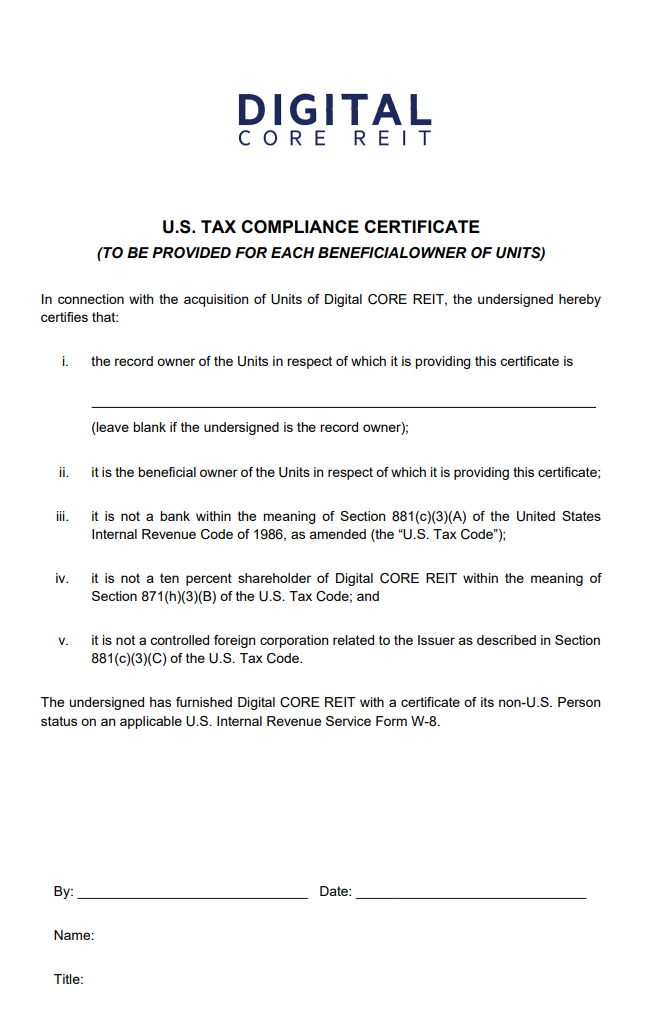

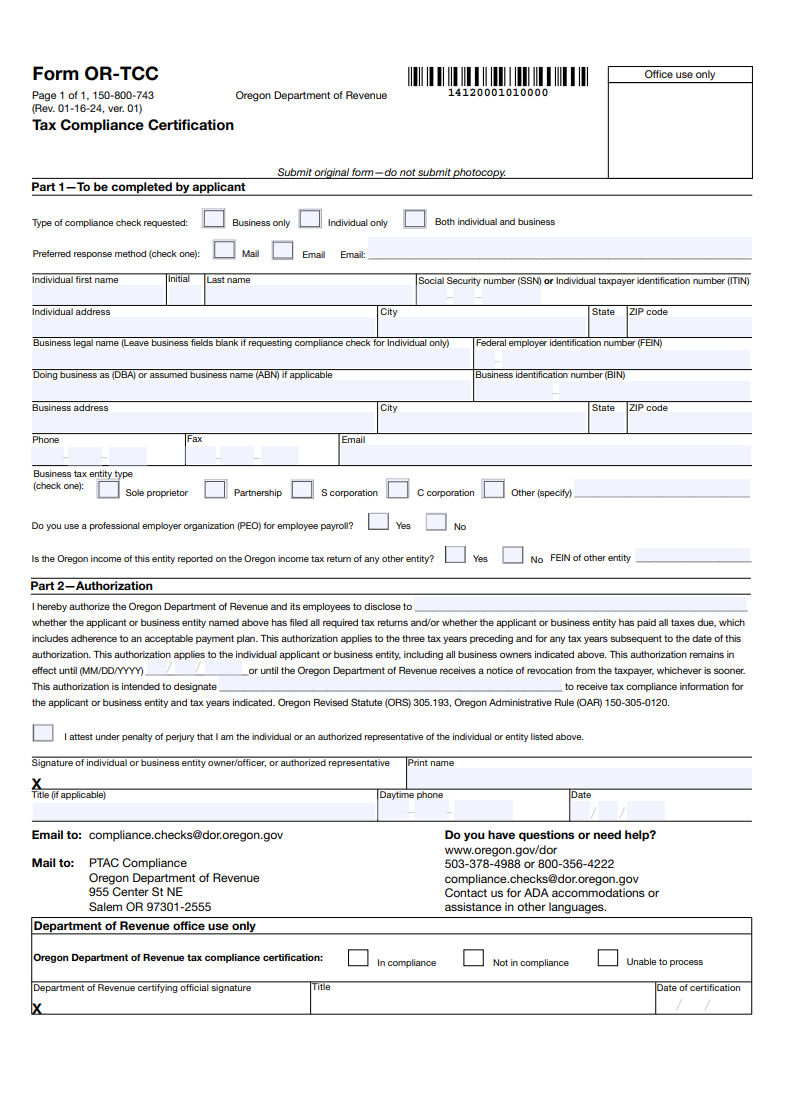

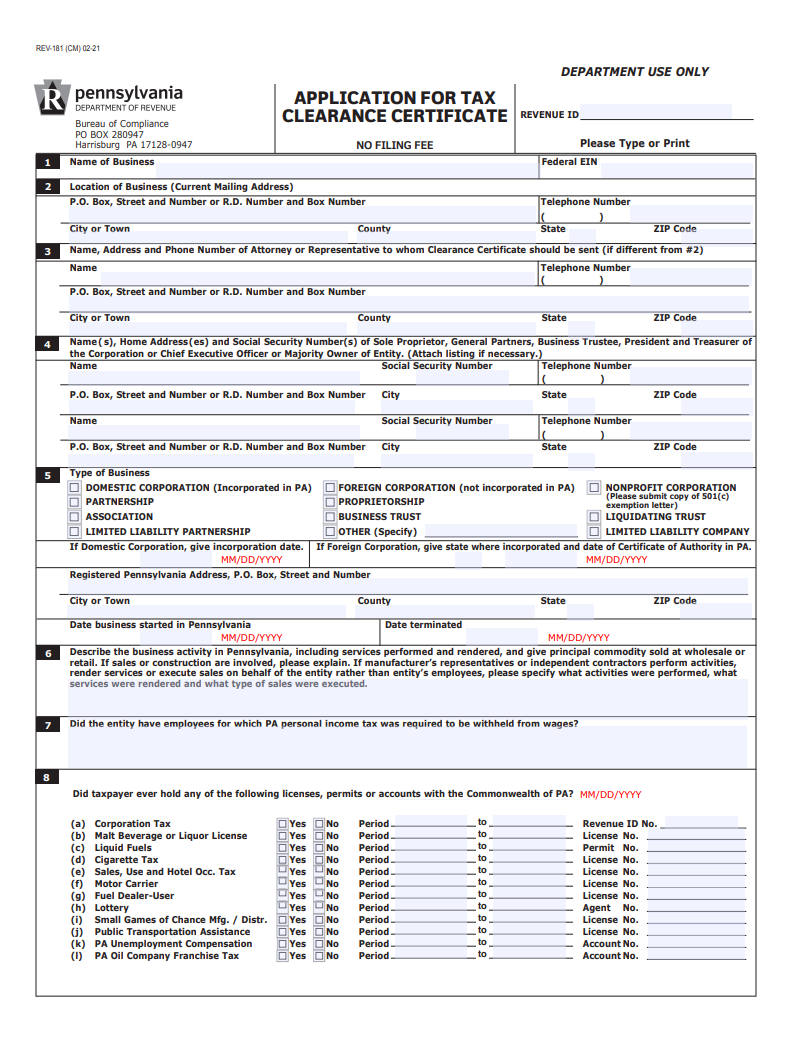

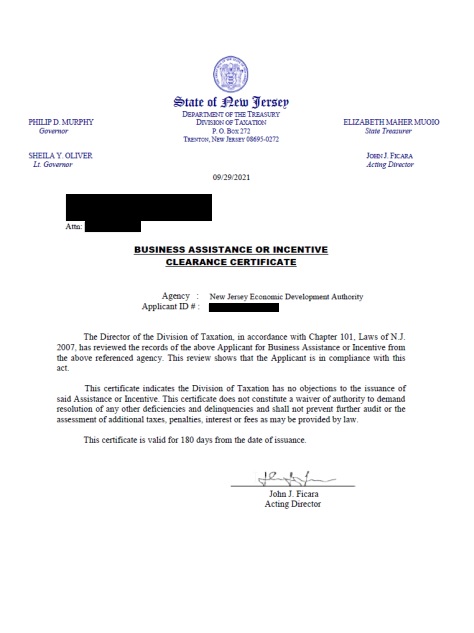

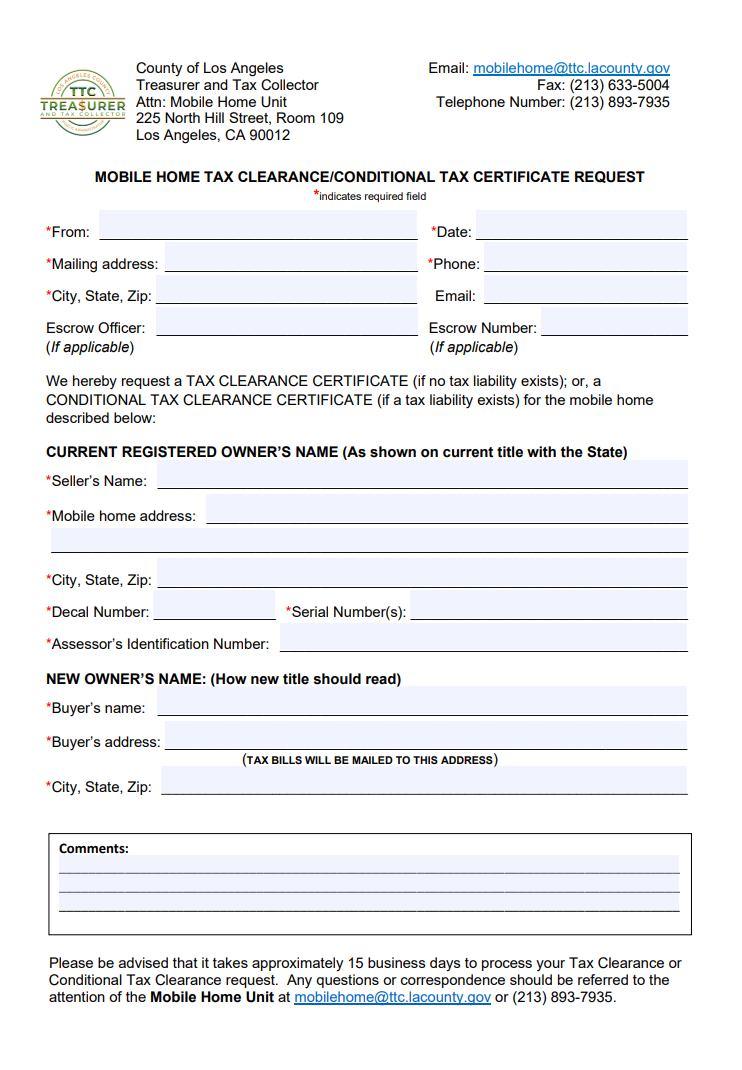

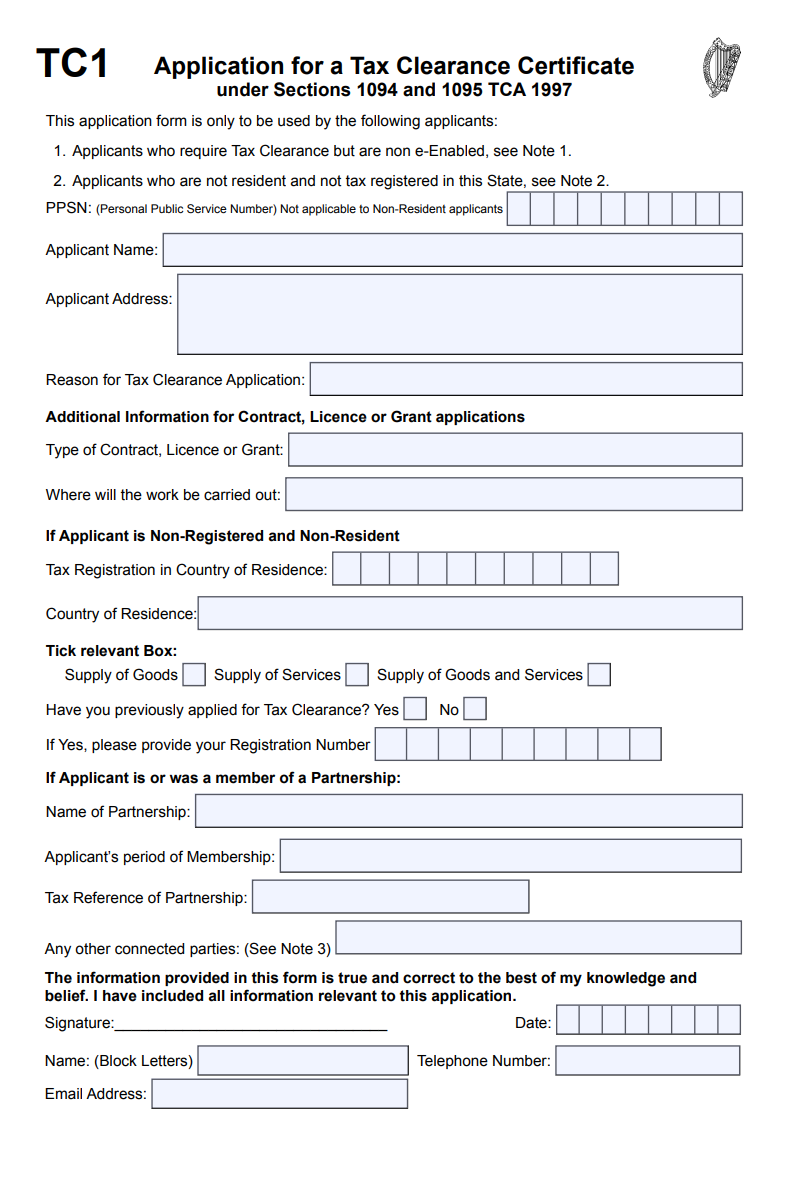

Subsequently, different countries have different rules and regulations when it comes to obtaining a tax clearance certificate and businesses and individuals should follow that accordingly. A tax certificate consists of a heading in which the name of the country is mentioned. For example, the Republic of China or the government of Pakistan and the address of the main tax office. After that, it gives a bold heading of the tax clearance certificate and under that it states the name of the organization or the name of the person to whom this certificate will be given. Then, it has an address of that specific company or individual. After this part, it is written clearly that this certifies whether the taxpayer above has paid or does not have any unpaid taxes pending. In the last section, the certificate issue date is mentioned along with the signature and stamped by the authorized person.

Importance of Tax Clearance Certificate:

Having a tax clearance certificate for business shows that the company does consider and follows the rules of the country and has a respectable reputation. It gives a clear idea about the company’s good will and values. Moreover, this certificate helps businesses when it comes to partnerships or joint ventures. Basically, the tax clearance certificate shows their partners or new partners that the concerned company is responsible and has a good record in legal terms with the government of the country. In addition, it helps gain the confidence of your new or current partners to join your business without any hesitation and believe that their partnership or agreement process will go smoothly till the end.

Details of Tax Clearance Certificate Template:

A tax clearance certificate is used as an essential document which you should have by your side in different scenarios. For example, when buying a house or vehicle, traveling out of the country, opening a new business or branch, new partnership, renewal of agreement and any job related to government. By having a tax certificate, businesses or individuals can feel safe that the tax authority department will not interfere in their business or daily operations. As we know that it is the job of the tax department to visit any company at any time or day to any company to check that the organizer has paid their due taxes or not. This is a real thread for a running business. So, to keep yourself and your company safe, it is better to have a tax clearance certificate in hand.